Accounting Entries For Cancellation of DebenturesAccounting Entries for Fully Convertible DebenturesAccounting Entries For Partly Convertible DebenturesAccounting for Redemption of Debentures notesAccounting Treatment for Discount or loss on Issue of DebenturesDebenture Redemption ReserveDisclosure of DRR in Balance SheetJournal Entries related to Discount or Loss on Issue of DebenturesMethods of Redemption of DebenturesRedemption of Debentures by ConversionRedemption of Debentures by Purchase from Open MarketRedemption of Debentures in Installments By Draw of lotsRedemption Of Debentures in Lump SumSources of Redemption

Monthly Archives: February 2023

AS- 3 Cash Flow Statement notes

AS- 3 Cash Flow Statement

A statement that shows flow of cash and cash equivalents of a particular period of time. It is a summary of receipts and payment of cash for a particular period of time. It also explains reasons for the changes in cash position of the firm.

Cash flow statement is generally prepared for one financial year (April to March).

Cash means cash in hand and cash at bank /demand deposits with banks.

Cash equivalent is a highly liquid investment whose maturity period is three months or less. It is subject to a minimal risk of a change in value.

Cash equivalent includes Marketable securities / short term investment, short term deposits in banks, cheques and drafts on hand, certificate of deposits.

Note – Until and unless, question specifies, short term investment is considered as marketable securities. Otherwise it will be taken as current asset while solving question.

Cash Flow means inflow and outflow of cash and cash equivalents.

Inflow – Any transaction that increases cash and cash equivalent of a company

Example –rent received cash revenue from operations, sale of investment etc.

Outflow – any transaction that decrease inflow and outflow of a company.

Example – repayment of loans and advances, payment to creditors, operating expenses paid etc.

AS -3 requires preparation of cash flow statement under three heads:

Cash Flow from Operating Activity

It includes cash flows from the principal revenue generation activities of an organisation.

Cash flow from investing Activity

It includes cash flows from sale and purchase of noncurrent assets, investments (which are not included in cash equivalent) and earning generated on those investments.

Cash flow from financing Activity

It includes cash flow resulting out of change in shareholders’ fund and noncurrent liability of an organisation (raising and repaying finance of an organisation).Note – We will see the examples of all three activities in CFS format.*

Financial Accounting Ratios & types of Accounting Ratio – Liquidity ratio, Profitability ratio, Turnover or Activity ratio, Solvency ratio

Financial Accounting Ratios & types of Accounting Ratio – Liquidity ratio, Profitability ratio, Turnover or Activity ratio, Solvency ratioDownload Ratio Analysis Ratio means comparison of quantitative relationship between two common variables that expresses how much bigger one is than the other. Accounting ratio analysis is a scientific and effective tool of evaluating operating and financialContinue reading “Financial Accounting Ratios & types of Accounting Ratio – Liquidity ratio, Profitability ratio, Turnover or Activity ratio, Solvency ratio”

Accounting For Issue of Debentures

Accounting for issue of debentures at Par, Premium, Discount, as collateral security, Writing off Discount/ Loss on issue, redemption & Interest on Debentures

Download Accounting for Issue of Debentures

Accounting-For-Issue-of-Debentures-RBL-Academy-8920884581

Debentures

It is a financial instrument, issued by Companies to raise Funds from the Market that acknowledges Payment of Interest on regular intervals and Repayment of Principle on maturity of the instrument to its holders.

It includes Debentures, Stock, Bonds or any other Instrument of a Company that evidences debt on it.

It can be redeemable (having maturity period) or Irredeemable (No maturity period.) (Explanation of Types of Debentures has been ignored intentionally.)

Disclosure of Debentures in Balance Sheet

Debenture is generally a long term Financial Instrument, a means of raising Long term Finance for the Company that falls under Non Current Liability Head in Balance Sheet.

An Extract of Balance Sheet

However, if it has been issued for a period of Less than 12 Months, then it falls under Short Term Borrowing under Current Liability Head of Balance Sheet.

Note:

In Case, Part of Long Term Debentures become due for redemption before maturity within 12 months from the date of Balance Sheet, it will be recorded in Other Current Liability under Current Liability Head as “Current Maturities of Long Term Debts”.

Issue of Debentures

Debentures can be issued for Cash or Consideration other than Cash.

Further, whether issued in Cash or For Consideration other than Cash, it can be issued at Par, Premium or Discount.

Accounting for Share Capital

Share Capital

Funds raised by company by issue of shares.

Two types:

Equity Share

A share that provides voting rights to its holders, belong to owners of the company, carries maximum risk and return, in which dividend is not fixed and on winding up of the company the holders of these shares receive only what is left after paying off all the liabilities and obligations of the company including Preference Shareholder repayment.

Preference Share

A share which carries a preferential right to get fixed dividend over equity shares to its holders and repayment of capital before holders of equity share capital. It does not carry voting right.

Classification of Share Capital

Authorised or Nominal Capital

Maximum amount of share capital that a company can raise as per Memorandum of Association.

Reconstitution of Firm – Admission Of Partner

ADMISSION OF A PARTNER

According to Section 31 of Indian Partnership Act, 1932, New Partner shall be admitted in the Firm only when all existing partners agree to admission of new partner or it is agreed otherwise by partners in Partnership Deed.

Change in Profit Sharing Ratio

Change in Profit Sharing Ratio takes place at the time of Reconstitution of Firm. In this chapter Admission of new Partner will lead to change in Profit Sharing Ratio of a Partner in existing firm. Since, New or Incoming Partner acquires his/her share from old Partners; therefore, we need to determine New Profit Sharing Ratio and also Sacrificing Ratio.

New Profit Sharing Ratio

New Profit Sharing Ratio is the ratio in which all Partners, including new Partner, share future profits and losses of the Firm. New Partner acquires share from Old Partners through different ways. There are different cases related to acquisition of Shares by New Partner from Old Partners

Goodwill: Nature & Valuation

Goodwill

Goodwill is refers to brand image of a company and monetary valuation of income that it can generate due to its brand value in the market.

Goodwill is of two types:

Self Generated Goodwill — It is brand image of a business organisation generated over a period of time of its business in the market. It is not accounted or written in Balance Sheet.

Purchased Goodwill — It is excess of price paid for a business as a whole over the Book Value or Agreed Value of all tangible net assets purchased.

Methods of valuation of goodwill

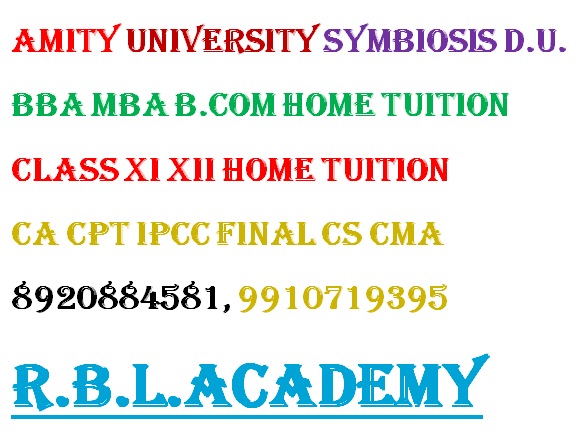

TUTORING SUBJECTS IN DEMAND FOR HIGHER SECONDARY EDUCATION

coaching centers in Noida, RBL Academy, best coaching center in Noida, class 12 home tuition, coaching in Noida, accounts coaching, Business studies home tuition , home tuition, coaching classes, accounts home tuition, business studies coaching, economics home tuition in noida, accounts home tutor in Noida, economics home tutor in Noida, business studies home tutor in Noida, Sociology home tuition in Noida, Psychology home tuition in Noida

Increasing Demand of Home Tutors & Home tuitions in Noida

Keywords: home tuition in Noida, home tutors in Noida, class 11 home tuition in Noida, class 12 home tuition in Noida, class 11 home tutors in Noida, class 12 home tutors in Noida, BBA home tutors in Noida, Mba home tutors in Noida, BBA home tuition in Noida, MBA home tuition in Noida It isContinue reading “Increasing Demand of Home Tutors & Home tuitions in Noida”

Accounting For Partnership

Partnership

Association of two or more persons who agree to do business carried by all or any of them and share its profits and losses.

Partner: Members of Partnership.

Firm: All members combined together to form a partnership is collectively known as Firm.

Firm Name- The name under which Partnership Business is carried on.